Investment: Fair & Square An I nterview with ANFAL AHMED : Founder of Square Funds

Can you tell us more about Square Funds and what inspired you to start the business?

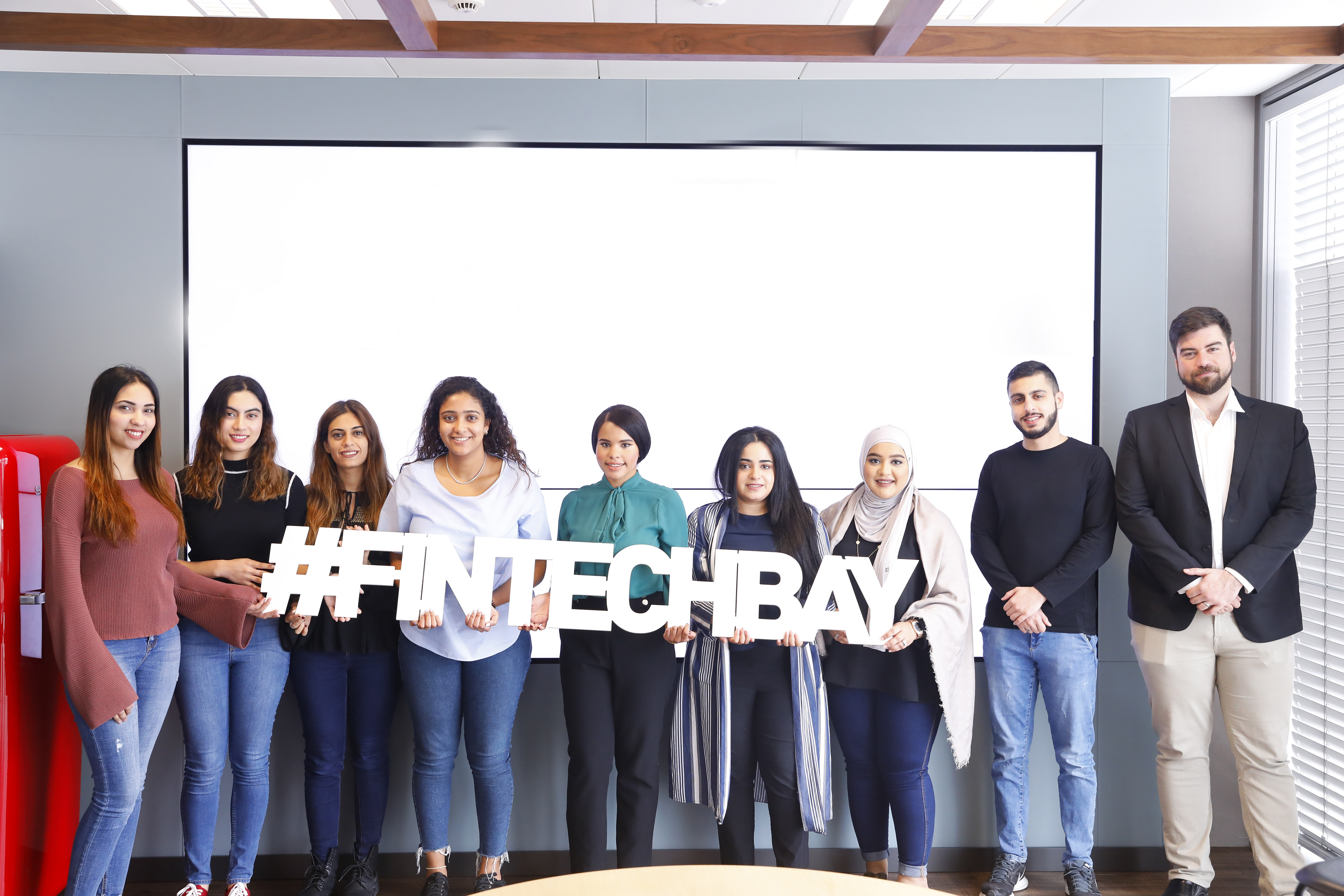

At Square funds we help our customers find the right investment products. Square Funds is an informative comparison platform powered by AI for saving and investment products offered by reputable financial firms. We are currently working in the Bahrain Fintech Bay. In my years working as a financial broker, I encountered a lot of micro-investors trying to find the right investment option for financing their kids’ education, marriage or just to serve as an additional source of income. They just couldn’t seem to find the right fit; something affordable and tailored to their specific needs. So I then took it upon myself to find a way to match investors with investment products. That’s how Square Funds was born.

Please tell us more about the concept of micro- investing and how micro-investors and micro- businesses can benefit from Square Funds.

The need for small businesses and individuals to own investment portfolios cannot be overemphasized. Your investments could be your saving grace for that rainy day. Investments are also a way of securing financial freedom. At Square Funds platform, we help our clients find and compare investment products offered by banks and other financial institutions where they can select suitably affordable options to cover their specific needs. Square Funds also help SMEs set aside a part of their capital to invest in mutual funds so that they can have a source of income even when business isn’t doing so great; instead of solely relying on revenue from normal business operations. The idea is to diversify and have a steady income stream from different sources to help sustain businesses even through hard times.

The need for small businesses and individuals to own investment portfolios cannot be overemphasized. Your investments could be your saving grace for that rainy day. Investments are also a way of securing financial freedom. At Square Funds platform, we help our clients find and compare investment products offered by banks and other financial institutions where they can select suitably affordable options to cover their specific needs. Square Funds also help SMEs set aside a part of their capital to invest in mutual funds so that they can have a source of income even when business isn’t doing so great; instead of solely relying on revenue from normal business operations. The idea is to diversify and have a steady income stream from different sources to help sustain businesses even through hard times.

Square Funds gives investors all the information they would need before making an investment decision so they can pick the right investment plan perfectly suited to their needs at no hidden cost. Investment products are offered through:

- Saving-investment schemes

- Mutual Funds

- Savings Account

What are your launch plans and what do you aim to achieve in your first year of business?

We are launching pretty soon in the Bahrain market. Our target is to cover at least 23% of the market share and help over 25,000 clients find the right investment option.

How are you guys disrupting the investment game? And how do you envision the future of investing?

Whatever your needs or the size of your pocket, Square Funds helps you find the best fit. We employ artificial intelligence and machine learning techniques to firstly, identify the investor’s risk profile and goals. This helps us understand the investors’ needs and we can then guide them to select the optimal investment plan. All these is done in the most efficient manner with little or no errors. We achieve this efficiency by:

- Providing all the information to the investor about the available investment options.

- Showing suitable investment products depending on the investor’s risk profile and financial goals.

- Helping fund managers pick investment schemes that are well-suited to the client’s desires.

Square Funds makes the entire process simple and seamless. It can all be done online, our platform makes it easy for investors to find investment opportunities that they would have otherwise missed.

I think what’s most important is to do work that you are passionate about. When you work on projects that you truly believe in, it becomes easier to overcome challenges. For Square Funds, it was the passion and desire to make investment opportunities accessible to all that has led us to where we are today. Also, make sure you understand the needs of your customers and that you employ the very best technology in producing world-class solutions.