Equal Opportunities

An Interview with Zeeba Askar, CFA Investment Director of Ithmaar Development Company/ Chairperson of the Women Inclusion Committee and Board Member at CFA Society Bahrain

Please give us an overview of the national award that CFA Society Bahrain received for the Advancement of Bahraini Women.

CFA Society Bahrain won the first place in the NGOs Category of HRH Princess Sabeeka bint Ibrahim Al Khalifa, Wife of His Majesty the King and President of the Supreme Council for Women Award for the Advancement of Bahraini Women, in its 6th edition. We would like to extend our sincere gratitude and appreciation to HRH Princess Sabeeka for her constant support and directives for the advancement of Bahraini women under the leadership of His Majesty King Hamad bin Isa Al Khalifa. We would also like to extend our deep appreciation to the Supreme Council for Women led by the Secretary General H.E. Ms. Hala Al Ansari for their support and encouragement.

This award is an essential part of the “equal opportunities” theme included in the national strategy for the Advancement of Bahraini women. It aims principally to benchmark and highlight the national women Advancement efforts, ensure sustainability of gender balance, promote the culture of “equal opportunities”, exchange experiences and encourage innovation in mapping out policies to boost women’s participation and integrate their needs with the Economic Vision 2030. CFA Society Bahrain was established in 2006 as the local member society of the CFA Institute. CFA Institute is a global, not-for-profit organization with over 150,000 members and over 150 local member societies worldwide. The Society was established with the main objective of developing and shaping the principles of the investment profession in the Kingdom of Bahrain in a manner that serves the economic development of Bahrain, by promoting the role of the investment profession and working on the realization of the professions’ objectives within the provisions of the applicable rules and regulations.

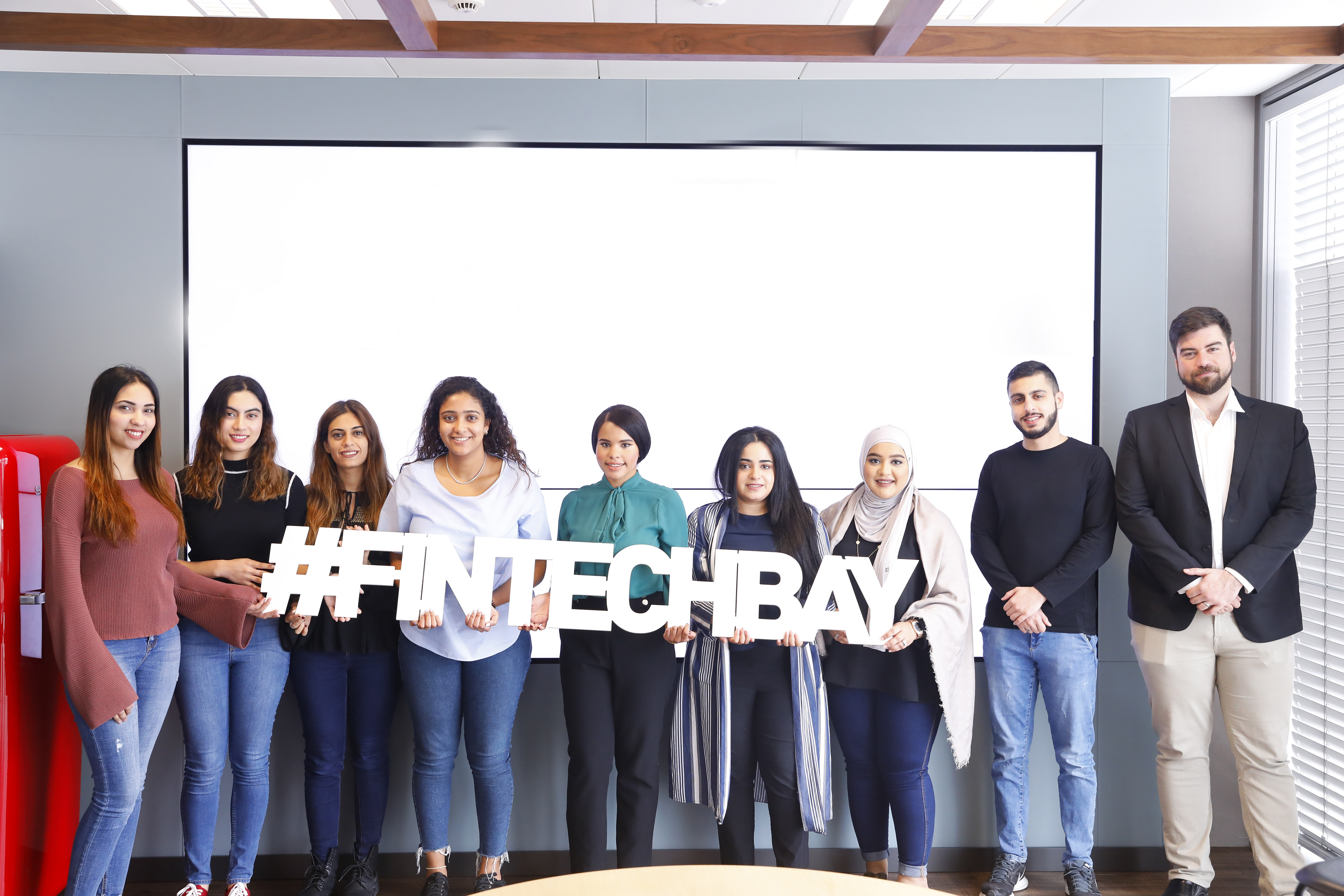

The Society is led by 6 Board members and has over 35 ambitious, talented volunteers who assume different roles and lead the various activities of the Society. Being a professional society, we strive to offer equal opportunities and at the same time encourage women to take up leadership positions. For example, 50% of the Society’s Board Members are women, while 44% of the leadership in the various Society initiatives is held by women. Furthermore, of the total group of volunteers, 53% are women. CFA Society Bahrain formed the Women Inclusion Committee, chaired by myself along with deputies Walaa Al Shehab and Mariam Al Shaikh, CFA to align itself with the CFA Institute’s global initiative “Future of Finance– Women in Investment Management Initiative.” At the same time, we work closely with the Supreme Council for Women on its initiatives to equip women with relevant skills and knowledge that will enable them to progress in their careers and reach executive leadership positions.

Can you tell us more about your role as Director of Ithmaar Development Company (IDC) and what this entails?

Ithmaar Development Company (IDC) is part of the Ithmaar Banking Group and is the real estate development arm of the group. My role as Director of Investments, encompasses activities which have a significant impact on the bottom-line of IDC while also creating social / physical infrastructure for the Kingdom. One of the landmark projects I worked on, was the region’s first Public Private Partnership (PPP) Housing project in the Kingdom. I was involved in the commercial negotiation for this project with the Ministry of Housing while leading the financial structuring of the project. This project involved working closely with international engineering, financial and legal advisory firms. I also represent IDC in some of our subsidiaries’ Boards. I have managed investments with ticket sizes of up to US$500 million and my role includes contributing to board level issues, when needed, at the group level. In brief, this leadership role is a strategic asset management function.

In 2017, I was nominated by Ithmaar Bank as its representative in the Bahrain Association of Banks (BAB), where I serve as the Deputy Chairperson of the Sustainable Development Committee.

This committee worked extensively to develop “Policy Recommendations for Regulatory Consideration on Sustainable Finance.” Another key achievement of the Committee is Tamkeen’s Solar Financing Scheme where the Committee collaborated with Tamkeen to structure a mechanism that encourages financing solar energy companies and projects.

What is the role of banks in the entrepreneurial ecosystem and moving forward to the financial security of the region?

What is the role of banks in the entrepreneurial ecosystem and moving forward to the financial security of the region?

Whether it is an entrepreneurial ecosystem or not, it is a given that banks are the lifeline of any thriving economy. When banks in any country step-up and provide a strong support framework to the entrepreneurial spirit of citizens, it makes a major difference in not only broad basing the economy but in also providing an impetus to the employment opportunities there. Coming to the specific role of banks in this regard, their investment philosophy and sectoral strategy is critical to the strengthening of the entrepreneurial ecosystem in any country. Bahrain has adopted the 2030 Sustainable Development Agenda of the United Nations which includes 17 Sustainable Development Goals (SDGs). Recognizing the importance of pro-actively

involving the banking community at the highest levels in taking forward the SDG goals, the Bahrain Association of Banks (BAB) formed a permanent committee to examine and identify

sustainable development opportunities for the banking sector. The Sustainable Development Committee, which comprises 16 representatives of banks and financial institutions in the Kingdom,

has engaged with numerous stakeholders to develop the “Policy Recommendations for Regulatory Consideration on Sustainable Finance” and the “Tamkeen Solar Financing Scheme” which was

structured to encourage investment in the sustainable energy sector.

Bahrain has been at the forefront of striving to diversify its non-oil economy for the past few decades. While ALBA was conceived in the late 1960s, precisely for this reason, the rapid development of the banking sector from the mid-1970s onwards is another indicator of Bahrain’s pioneering status in the GCC in its journey of economic diversification, away from the

hydrocarbon sector. The opportunity as a separate asset class for sustainable banking and finance globally, has provided added momentum for Bahrain to further align its banking sector to its global peers, giving due consideration to a more sustainable, economic future. Being a significant contributor to the GDP, the banking and financial services sector of Bahrain has

every reason to keep up with the growing dynamics of financing.

With banks and financial institutions investing heavily in a new technologyenabled environment that allows users / consumers to undertake financial transactions on their mobile devices,

FinTech is another focus area. As part of the Central Bank of Bahrain’s (CBB) ongoing initiatives towards digital transformation in the Kingdom and developments in digital financial services, the CBB established a dedicated Fintech & Innovation Unit to ensure that the best services are provided to individual and corporate customers in the financial services sector by encouraging an agile regulatory framework that fosters FinTech and innovation. Another initiative by the CBB was introducing a Regulatory Sandbox that allows startups, FinTech

firms and licensees to provide innovative banking and financial solutions, in addition to the issuance of crowdfunding regulations for both conventional and Sharia-compliant services.

The future is in capturing opportunities that are “stakeholder-centric” that will benefit the whole community. The roadmap to that is building sustainable economies that will benefit everyone. The Tamkeen Solar Finance Scheme is a start in the right direction and we aspire to work on similar initiatives to encourage the expansion of a more sustainable economy

that will help further boost economic growth in the region.

What are some pitfalls that you see entrepreneurs doing, especially in terms of financing their businesses?

What are some pitfalls that you see entrepreneurs doing, especially in terms of financing their businesses?

Entrepreneurs often underestimate the importance of financial planning and its consequences on successfully running a business. I have been consulted by a number of entrepreneurs before

they set up their business. One of the common pitfalls that I noticed include underestimating the cost of running the business whereby important cost elements are missed out; and investing

heavily in fixed overhead cost which burdens the capital of the company at an early stage. Ensuring efficient capital deployment and ramping up capital deployment depending on the growth

trajectory, offers significant benefits in terms of better financial management of the company. Occasionally, the unexpected response of competitors or overestimating the business growth

could result in a liquidity mismatch which could potentially disrupt the company’s operations. Focusing on solid growth, preferably organically driven, and having the determination to follow through in the medium term to deliver on customers’ preferences / ever changing tastes is another factor that should be very well thought through, depending on the kind of business that is started.

As a woman leader in the financial sector, how do you encourage and inspire more women into traditional “male” fields?

As many wise people have said repeatedly over centuries – learning is a lifelong process – it is a never ending journey. Once we understand and apply this principle, it becomes part of our

strategic thinking to continue building on our competencies and technical skills. This will then help us give the fullest to our efforts and work. Demonstrating confidence and preparedness to be up for the challenge in any field and not shy away from putting ourselves out there to do the work and deliver results is an essential trait. Working women go through different phases during their lives which could result in varying levels of pressure, such as going through motherhood and the desire of balancing family and work responsibilities, to name a few. I noticed some talented and ambitious women step down in the middle of their career because they felt their family deserved more attention from them. The flexibility of organizations in supporting women pass through this phase would be a great form of support to ensure the growth and continuity of high-caliber women in the sector. Maintaining healthy work-life balance and training yourself on time-management are key, the secrets of which needs to be unlocked by each women depending on their unique circumstances. I would rate the occasional “Me Time” as being very

important for every woman!

What advice can you give to aspiring entrepreneurs and startups?

I would like to refer to an inspiring quote from Oprah Winfrey – “the best way to succeed is to discover what you love and then find a way to offer it to others in the form of service”. Starting your own business is a courageous step and requires long term commitment and dedication for it to succeed. It is important to keep up with the ever changing customer demands / tastes, the changing technology and the resultant paradigm shift in the way business is conducted. Upcoming shifts in the global economic dynamics will give birth to new businesses, while others may fade away. Therefore ensuring delivery of high quality products and services is critical. Human Capital remains the major driver of business, invest wisely in the people

you hire and remember that their growth is your growth! Financial management is what keeps the company running, it is why you started your business: be on top of the numbers and manage resources efficiently. Always remember why you started! Be action oriented and manage your energy and the energy of your team to be resilient! Setbacks do happen, what matters is to learn the lessons from them and keep moving on. Finally, I cannot over emphasize the power of building your network! This is one of the key pillars of building and growing your business.