BisB Launches ‘End-to-End Mobile Account Opening for Corporate Customers’ on BisB Corporate Digital

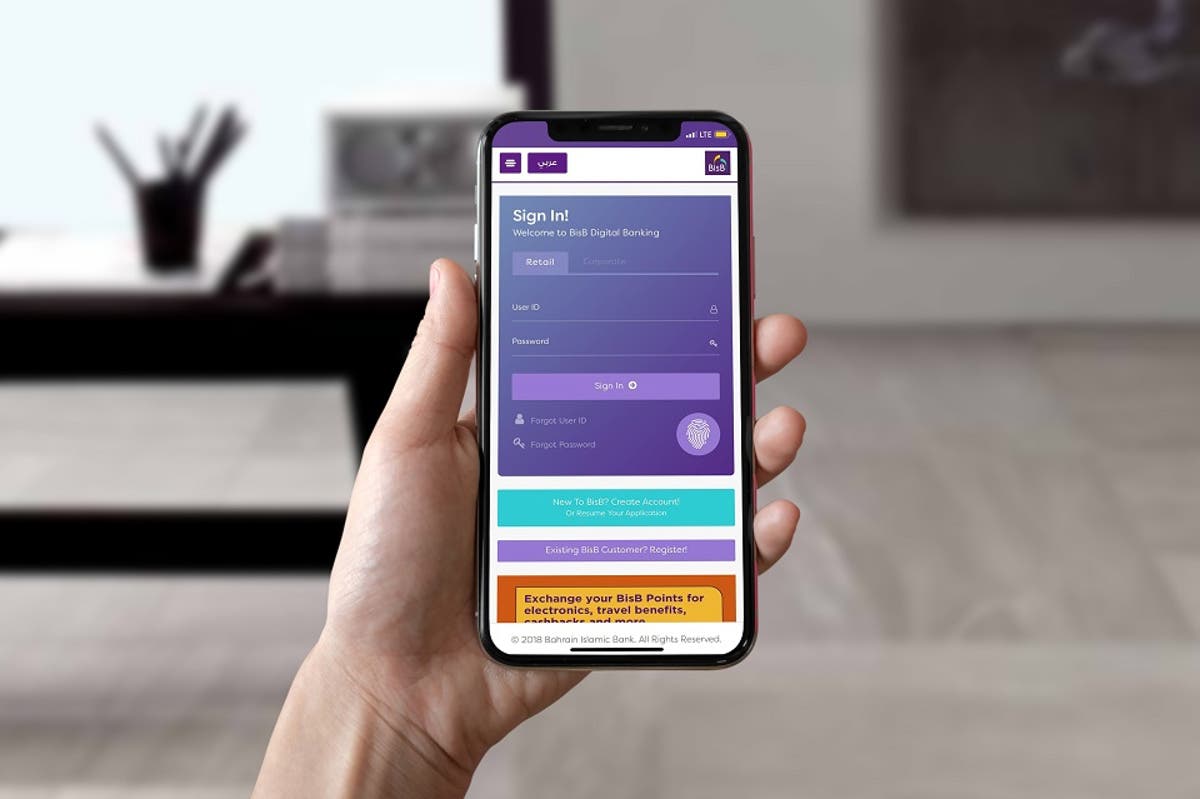

As part of its efforts to deliver on its promise of simplifying its customers’ money matters and transforming the face of the traditional customer service, Bahrain Islamic Bank (BisB) recently launched its latest digital innovation for its corporate customers. The new end-to-end digital service allows individual establishments and Sijili customers to open and operate a corporate account using facial recognition via the Bank’s corporate mobile application, BisB Corporate Digital, in a few minutes. The launch of this latest Corporate service completely eliminates the hassle of customers needing to physically visit the Bank’s branches, providing the ultimate level of convenience and increased level of safety considering the ongoing COVID-19 pandemic.

“The launch of our latest digital service is a significant milestone for the bank as the first bank in Bahrain to offer end-to-end corporate account opening online in such a reduced time and has established a new benchmark for the entire industry, opening up a whole new world of opportunity for our corporate division by providing an unparalleled level of convenience. This comes in line with our simplification strategy at BisB, which seeks to push the boundaries of innovation by launching digitally-empowered solutions to provide a transformed customer experience thereby enabling businesses and corporates to swiftly go about their daily business with increased efficiency. We are confident this achievement will contribute towards strengthening the Kingdom’s position as a leading financial and fintech hub in the region,” said the Chief Corporate & Institutional Banking, Mr. Wesam Baqer.

“This digital innovation goes beyond creating an improved experience for the bank’s corporate customers by offering increased convenience through a simplified process and shorter time frame. The launch of this service will revolutionize finances for corporations in the Kingdom of Bahrain, because we can better cater to more diverse segments in a far more holistic manner, for the likes of aspiring entrepreneurs and start-up businesses, or Instagram-based businesses.

Combined with the power of being able to register for a Commercial Registration via the Kingdom’s Virtual CR system, Sijili, this simplifies the process for any business that wants to start a new business in Bahrain, further contributing towards the growth of the Kingdom’s budding entrepreneurial ecosystem,” he added.

To ensure the highest level of security, customers are requested to upload a copy of their Identity Card once they sign up, using facial recognition as an added level of authentication. Once verified by the bank, customers can immediately apply for any of BisB’s corporate products and services and enjoy a seamless banking experience at their convenience.