BENEFIT ORGANIZED IDENTIFICATION AND VERIFICATION SERVICE WORKSHOPS FOR Financial Institutions

BENEFIT, the Kingdom’s innovator and leading company in Fintech and electronic financial transactions service delivered 2 workshops in their premise and 1 virtual workshop introducing their Identity and Verification services to 48 financial institutions in the Kingdom.

Representatives from 48 financial institutions attended the sessions, where they learned about the competitive features and capabilities of the solutions. The identification and verification service recognizes all GCC IDs and passports from all nationalities to validate client identity against a liveness check, allowing for faster and more seamless customer onboarding.

Capitalizing on the latest facial recognition technology, BENEFIT’s solutions are supported by cutting-edge biometrics technology to provide its new identification and verification solution. The system maintains stringent security standards, which are suitable for safeguarding sensitive processes such as remote financial transactions.

With the surging demand for digital onboarding and to facilitate virtual banks and fintech firms, the identification and verification solution is offered as part of BENEFIT’s digitalization agenda, and will facilitate remote client onboarding to various services, as well as digital services, resulting in improved customer experience.

Latifa Al Mutawa Head-Bahrain Credit Reference Bureau at BENEFIT, commented on the initiative, “Banks, Money Changers, Insurance companies, Investment firms, Payment service providers FinTech firms, and all other financial institutions face a similar challenge when it comes to providing consumers with more digital services at a time when cyber criminals are increasing their techniques and intensity. In light of this rising threat, BENEFIT’s technology plays a critical role in keeping people and data secure.”

“With the maturation of facial recognition, especially with the introduction of liveness checks, it is now a necessity in the biometrics realm and BENEFIT is leveraging on this and strengthening our role in the FinTech space. We are proud to add value to our innovative solutions and make a significant contribution to an enhanced customer experience, as we have consistently done.

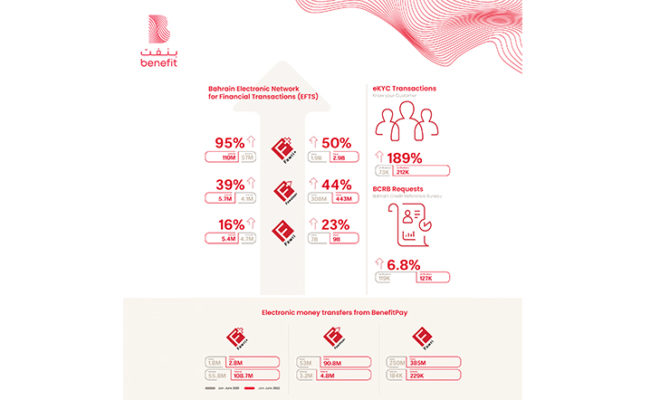

This initiative is consistent with BENEFIT’s track record of delivering market-leading solutions. To emphasize this, it is worth noting that BENEFIT also provides the national eKYC service and the credit bureau service, which when integrated together results in straight through processing and an improved customer experience” She added

It is worth noting that the Identity and Verification service by Benefit is offered with highly competitive features to fit all financial institutions needs