GOLD AND SILVER PROJECTED AS THE MOST ATTRACTIVE INVESTMENTS OF 2023

Leading global financial groups and research firms state that gold, silver and industrial metals are expected to be the best-performing commodities in 2023.

Global crude oil market is projected to remain tight but balanced in 2023, averaging $90 per barrel for the year.

According to a report by Prithvi Finmart, a leading Indian commodity market research firm, gold and silver could benefit from a weaker dollar, and emerge as the best asset class in 2023.

The stock market is rated as a risky asset class this year. On the other hand, oil drops 4% on strong dollar and China uncertainty and reports predict OPEC pricing power limiting oil price downside in 2023.

A report by Goldman Sachs says, “OPEC’s growing ability to raise prices without hurting demand too much will limit downside risks to the bullish oil forecast for 2023.”

Global oil demand growth will be averaging 2.7 million barrels per day (mbd) in 2023, pushing the market into deficit in the second half, leading to firming up of Brent prices to $105/bbl by Q4.

However, a relatively robust 1.3 mbd of oil demand growth is expected next year, despite expectations for the global economy to expand at a sub-par 1.5 percent pace in 2023, according to JP Morgan.

Natasha Kaneva, head of global commodities strategy at JP Morgan says, “Our forecast of a $90 Brent in 2023 centers on the view that the OPEC+ alliance will do the heavy lifting to keep markets balanced next year.”

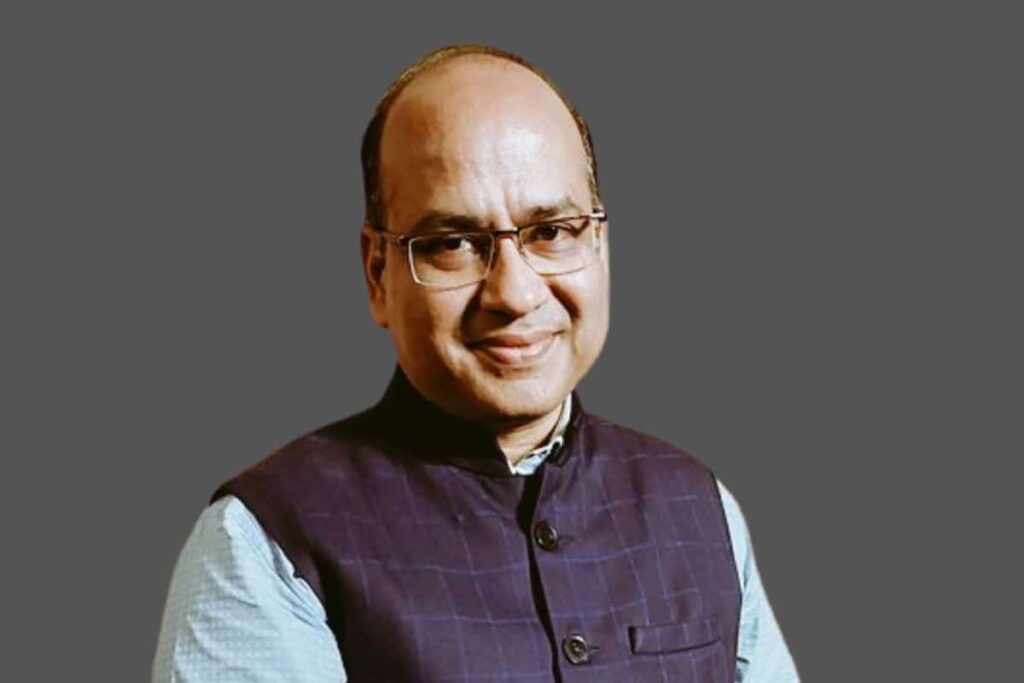

Manoj Jain, a currency market expert and director of Prithvi Finmart Pvt Ltd

Manoj Jain, a currency market expert and director of Prithvi Finmart Pvt Ltd

“Gold and silver are my top favorites for 2023. I expect gold could cross $2000 per troy ounce and silver could also test $28-30 per troy ounce levels [this year],” Manoj Jain, Director of Prithvi Finmart, told Arabian Business.

Source: Arabian Business