CROWDFUNDING IN BAHRAIN AND HOW IT WORKS

Crowdfunding creates opportunities for entrepreneurs to finance projects and businesses. Startup companies or growing businesses usually deal with service-based initiatives as a way of accessing alternative funds.

From the time the Conventional Financing Based Crowdfunding Regulations was introduced in Bahrain in 2017, recommendations have been forwarded in 2022 to further develop, regulate and update the platform for existing marketplaces.

What is crowdfunding?

Crowdfunding is an online fundraising method, an alternative lending platform that individual and groups of entrepreneurs use to fund ventures or raise capital in a collective manner. Money raised from crowdfunding are suitable for use in buying a property or in financing a project.

How can you access the crowdfunding market?

Entrepreneurs can easily fulfill the main platform requirements to obtain license and enter any one of the two existing crowdfunding models in Bahrain: first, the financing-based crowdfunding or “lending” and second, the equity crowdfunding.

Financing-based crowdfunding

This type of platform in Bahrain is designed to raise capital for borrowers based in the Kingdom—by as much as 500,000 Bahrain Dinars or around 1.3 million US Dollars; with the tenor of the loan not exceeding 5 years.

The prescribed scheme to raise funds is by creating for each issuer the escrow account with the licensed retail bank; since the Bahrain government only allows working with approved banks to facilitate transactions.

A minimum target amount of 80% is set for borrowers to raise on the platform; as an example, if a borrower is targeting to raise 100,000 Bahrain Dinars, the campaign will attain success if it raises at least 80,000 Bahrain Dinars.

Equity-based crowdfunding regulations

The limits are not the same for equity-based crowdfunding platforms in Bahrain, whereas startups can raise 250,000 Bahrain Dinars or 660,000 US Dollars via an online portal.

The required amount for real estate projects is 500,000 Bahrain Dinars in a 12-month period, which is the same as with financing-based crowdfunding. However, in 2022, the real estate offerings were amended and made available for retail investors.

Like in financing-based crowdfunding, if a company fails to attain 80% of the target amount via equity crowdfunding, the platform needs to refund all the investors.

The required period for an equity crowdfunding offer in Bahrain should not be less than 10 days or over 3 months. If the offer wasn’t successful or has not attained the 80% target, then the money should be refunded to investors within 7 days.

Gaining access into the Bahrain crowdfunding sandbox for a license

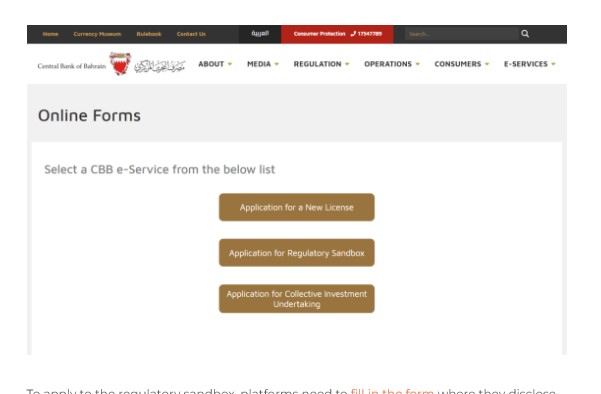

The Central Bank of Bahrain’s official website has an online form submission portal for obtaining a license.

Applying to the regulatory sandbox is simple: platforms must fill in the form requiring general information about the business and the purpose of applying to the sandbox. The business should outline any relevant KPIs and what follows after the “sandbox test” is completed should also be highlighted. The sandbox is valid up to 12 months, with room for extension upon request and approval. The application is basically for a temporal license to operate a crowdfunding platform in Bahrain and run a business.

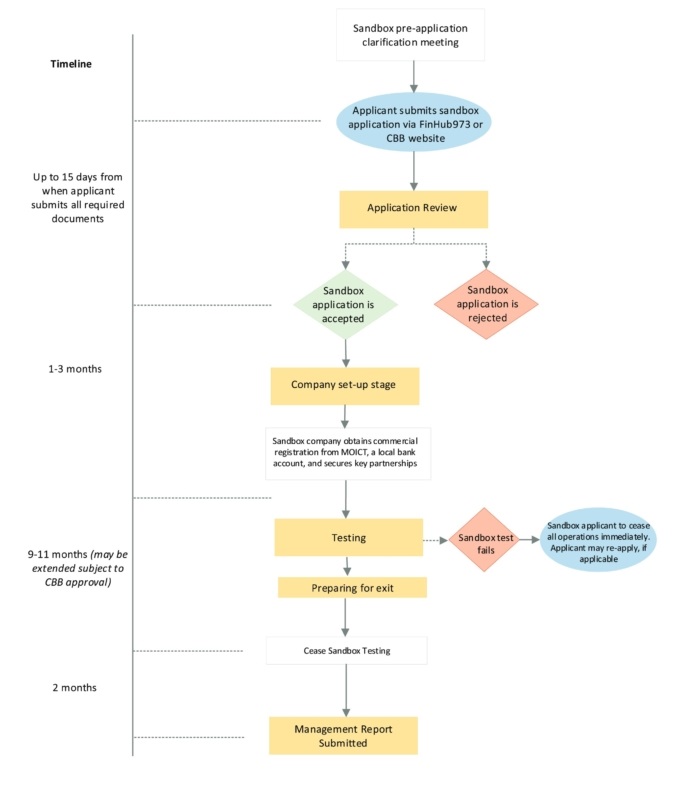

Process flow in applying for the Bahrain crowdfunding regulatory sandbox:

Several crowdfunding and investment platforms in Bahrain that applied for the license through the regulatory sandbox and are listed in the register. The platforms are at different development stages; and some of those operating in Saudi Arabia are also looking to get a license in Bahrain.

| PLATFORM | TYPE |

| Suyula | Receivables financing, debt arrangement, inventory financing; a debt crowdfunding platform from Saudi Arabia which also applied for a license in Bahrain. |

| Amal Invest | Shariah-compliant investing app for Muslims; aims to transform the funding model for early stage startups; designed for stocks and funds investing and provides automatic trading with zero fees. |

| Raseed | Stocks investing; a fractional shares investment marketplace with real time trading opportunities; offers ETFs and stocks investing for all types of investors with “any” dollar amount to get started. |

| Tasleefa | Loan aggregator in tandem with banks and other financial institutions to satisfy borrower request for a loan; also works with borrowers on the ASNEF list. |

Crowdfunding market landscape in Bahrain

The market is thriving with a vast potential for future developments. In addition, the amendments to Bahrain crowdfunding regulations are expected to encourage crowdfunding platforms in Saudi Arabia, Oman and UAE to obtain the license in Bahrain. It is also recommended to new crowdfunding platforms to enter the market if there’s excellent investor appetite as well as startup or real estate financing demand.

Source Credit: Lenderkit